Not known Details About Paul B Insurance

The bigger the variety of costs payers, the a lot more accurately insurance companies have the ability to estimate probable losses hence compute the amount of premium to be gathered from each. Because loss occurrence might change, insurers remain in a constant process of accumulating loss "experience" as a basis for periodic reviews of premium needs.

In this regard, insurance providers execute a funding formation function similar to that of financial institutions. Therefore, company enterprises acquire a dual take advantage of insurancethey are enabled to run by moving possibly debilitating risk, as well as they also may get funding funds from insurance providers through the sale of stocks and bonds, for instance, in which insurance companies invest funds.

For much more on the insurance sector's payments to society and the economy see A Firm Foundation: How Insurance Supports the Economy.

7 Simple Techniques For Paul B Insurance

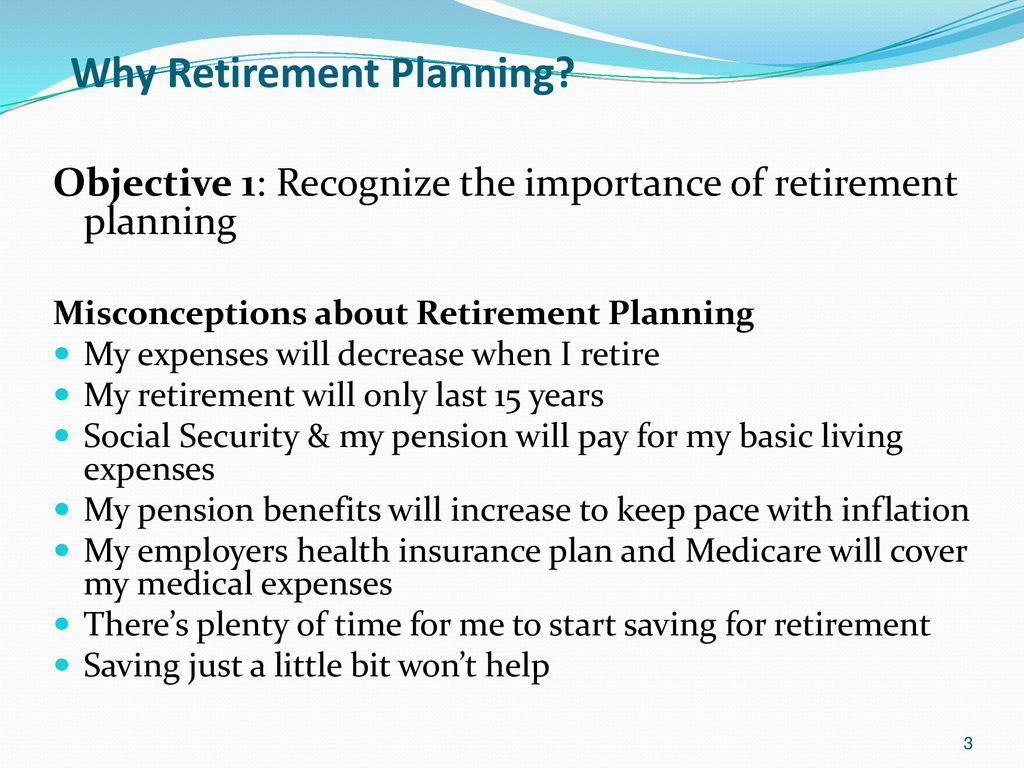

Being mindful of what's readily available and just how it functions can have a major impact on the rate you will pay to be covered. Armed with this understanding, you'll be able to choose the best plans that will certainly secure your way of living, assets, as well as building.

When you have something to lose, and also you can't afford to spend for a loss on your own, you spend for insurance. By paying money on a monthly basis for it, you obtain the comfort that if something fails, the insurer will spend for the points you need to make life like it was before your loss.

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

The insurance business has lots of clients. When a loss happens, they might obtain insurance coverage cash to pay for the loss.

Some insurance policy is extra, while other insurance, like auto, may have minimal demands laid out by law. Some insurance policy is not called for by legislation. Lenders, financial institutions, and home mortgage business will need it if you have actually borrowed cash from them to buy worth a lot of cash, such as a residence or an auto.

An Unbiased View of Paul B Insurance

You will certainly need automobile insurance coverage if you have an automobile financing and also house insurance policy if you have a mortgage. It is commonly required to qualify for a financing for big purchases like houses. Lenders intend to make certain that you are covered against risks that might create the worth of the car or house to websites decline if you were to endure a loss before you have actually paid it off.

Lender insurance coverage is extra expensive than the policy you would buy on your own. Some firms may have discounts tailored at bringing in certain kinds of customers.

Other insurers might develop programs that offer bigger discount useful reference rates to senior citizens or members of the military. There is no chance to understand without searching, contrasting policies, and also obtaining quotes. There are three major reasons why you ought to purchase it: It is needed by regulation, such as responsibility insurance for your car.

A monetary loss could be beyond what you could pay for to pay or recoup from easily. If you have pricey computer system equipment in your apartment, you will certainly desire to get renters insurance. When the majority of people believe regarding personal insurance coverage, they are likely thinking concerning one of these 5 major kinds, to name a few: Residential, such as home, apartment or co-op, or occupants insurance policy.

Our Paul B Insurance Ideas

, which can fall right into any of these groups. It covers you from being filed a claim against if an additional person has a loss that is your fault.

Insurance policy calls for licensing as well as is divided into teams. This suggests that prior to somebody is lawfully allowed to offer it or give you with guidance, they should be licensed by the state to sell and also give advice on the type you are getting. Your home insurance coverage broker or representative may tell you that they do not supply life or handicap insurance coverage.

If you're able to acquire more than one kind of plan from the same person, you may be able to "pack" your insurance policy and get a discount for doing so. This includes your major residence along with any type of various other structures in the room. You can locate fundamental wellness benefits along with various other health and wellness plans like oral or lasting care.

More About Paul B Insurance

:max_bytes(150000):strip_icc()/what-main-business-model-insurance-companies.asp-FINAL-092abcf238d348c4975e1021489191e6.png)

If you get an actually affordable price on a quote, you should ask what sort of policy you have or what the limitations of it are. Contrast these details to those in various other quotes you have. Plans all include certain areas that list limitations of amounts payable. This applies to all type of policies from health to vehicle.

Ask concerning what insurance coverages are limited and what the limitations are. You can typically request for the kind of plan that will certainly provide you greater limits if the limits received the plan issue you. Some kinds of insurance have waiting durations before you will certainly be covered. For example, with oral, you might have a waiting duration.

:max_bytes(150000):strip_icc()/CornRow-MediumShot-4466f176d8c64a2e855f7af76981c86f.jpg)